FAQ for the 2024 Promutuel Insurance Côte-Sud dividend

When and how will we be paid the dividend?

The dividend will be paid, starting on September 29, 2025, as follows:

• By direct deposit, if we have your banking information.

• By cheque, if we did not have your banking information on file as of August.

Please note that the Canada Post strike will delay the delivery of your confirmation letter and cheque.

Is it normal that I haven’t received my dividend?

If a balance is shown on your file or if your dividend amounts to less than $10, you could not receive one. Due to the Canada Post strike, cheques delivery will be delayed.

If needed, contact us at 1-888-265-7940 and ask for the Accounting Department. Longer response time is to be expected due to the increase in the number of calls caused by the strike.

To avoid delays caused by the strike, can I give my banking information and ask for direct deposit instead?

Unfortunately, you cannot make this change.

To avoid delays caused by the strike, can I pick up my dividend cheque at one of your offices?

This option is currently not available, but we are assessing the situation to see if we could offer you this option. Keep an eye on our web and social media pages for more details.

Am I entitled to a dividend for all my insurance policies with Promutuel Insurance Côte-Sud?

Absolutely! All insurance policies entitle the policyholder to a dividend. It’s possible that more than one cheque or payment will be made, since payment is issued according to the name on the insurance policy.

I’m insured with Promutuel Insurance through a broker. Will I get a dividend?

Of course! The dividend is paid to all insured members of Promutuel Insurance who are policyholders as at December 31, 2024, including clients of our partner brokerage firms.

How is the dividend amount determined?

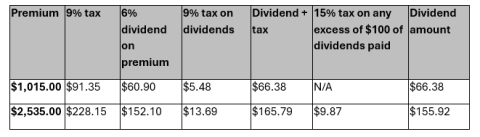

Our mutual is pleased to pay you a 6% dividend calculated based on your premium as at December 31, 2024. However, 15% of any amount more than $100 of dividends is withheld for tax purposes, as required by the Canada Revenue Agency.

Examples:

Who can I talk to if I have questions?

Call us at 1-888-265-7940 and select the Accounting Department.

Why is my dividend taxable?

All dividends received from a cooperative must be reported as income for the current tax year by the insured member who received them. To comply with tax requirements, we must deduct dividends exceeding $100.

Do I need to take any specific steps if the insurance policy for which I received a dividend is tax deductible?

Promutuel Insurance is responsible for issuing tax receipts to its insured members. Please ask your

accountant for more information about possible deductions and how to claim them.

You can use our secure form to provide us with your Social Insurance Number or Federal Business Number: www.promutuelassurance.ca/dividend.

Why do you need my Social Insurance Number or Federal Business Number?

If your dividend exceeds $100, Promutuel Insurance is required to send you a tax receipt that includes your Social Insurance Number or, for businesses, your Federal Business Number. This is required by the Canada Revenue Agency. Your Social Insurance Number or Business Number will then be securely deleted once the statutory retention period expires; no record of it will be kept in Promutuel Insurance’s computer systems.

Is your website secure?

For over 170 years now, Promutuel Insurance has been protecting your property, and your personal information is no exception. Rest assured that we have secure and rigorous processes in place to make sure your personal information never falls into the wrong hands. We also make sure that any information obtained is securely destroyed at the end of the statutory retention period.

Do I have to give you my Social Insurance Number or Federal Business Number?

The decision to disclose the number is yours. If we don’t receive it, Promutuel Insurance will send you a tax receipt in February 2026 that does not show your number.

I have an insurance policy with my spouse. Do we both have to provide our Social Insurance Numbers?

No, since the tax receipt is an individual document on which only one name can appear. Consequently, Promutuel Insurance will send a tax receipt to the insured member who has provided their Social Insurance Number.

When will I receive the tax slip?

The tax slip issued by Promutuel Insurance will be sent to you in February 2026.